The $50 Billion Rural Health Race: Is Your Clinic Positioned to Win or Fade Away?

Strategic Advisory for FQHCs and RHCs Across All 50 States

Subodh K. Agrawal, MD, FACC

Medical Director, Medical Office Force LLC

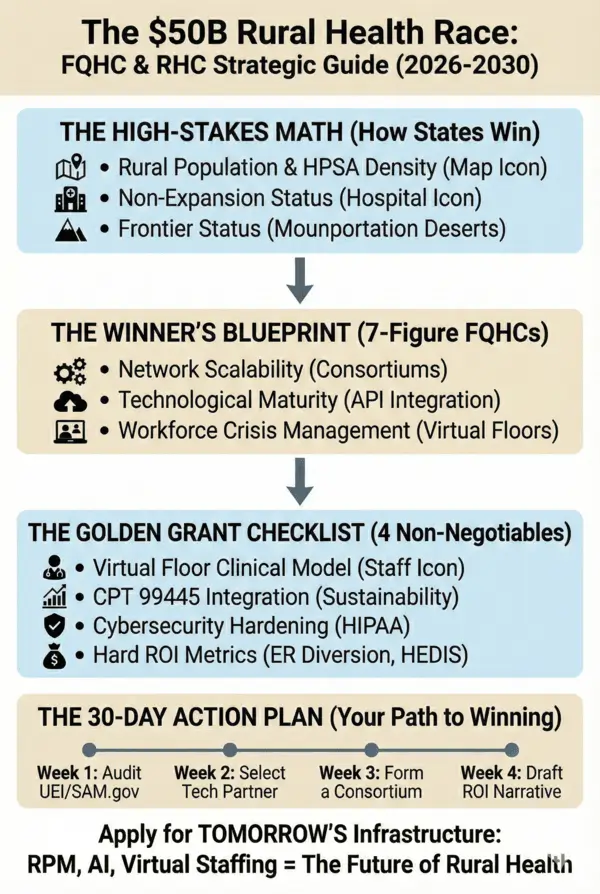

The federal government’s $50 billion Rural Health Transformation investment for 2026–2030 is the largest single commitment ever made to America’s safety-net healthcare infrastructure. For Federally Qualified Health Centers (FQHCs) and Rural Health Clinics (RHCs), this funding represents both a rare opportunity and a structural test.

This is not a stimulus program designed to “help everyone a little.” It is a performance-driven reinvestment strategy. CMS and State Medicaid Agencies are under pressure to demonstrate measurable cost reduction, access improvement, and quality outcomes within a short policy window. As a result, funds will move decisively toward organizations that can prove readiness, scalability, and financial sustainability.

Clinics that treat this as a traditional grant cycle will struggle. Clinics that approach it as a strategic transformation initiative will lead.

How the Money Actually Moves: The Funding Logic

At the federal level, allocations are driven by what can best be described as a “Need-to-Impact” ratio. States that can show the greatest return on each dollar invested receive disproportionately larger funding pools. This is why large, rural, Southern and Midwestern states continue to dominate allocations.

Four structural variables consistently influence funding weight:

- Rural Population Volume

Total population residing outside Metropolitan Statistical Areas remains the single largest driver of baseline allocation. - HPSA and MUA Density

Health Professional Shortage Areas and Medically Underserved Areas directly influence federal prioritization because they correlate with preventable mortality and high emergency department utilization. - Medicaid Expansion Status

Non-expansion states often receive higher stabilization and access grants to offset higher uncompensated care burdens. - Frontier Geography

Counties with fewer than six people per square mile receive additional weighting due to transportation, workforce, and infrastructure barriers.

- Rural Population Volume

The result is predictable: states with high rural burden and limited provider density generate the highest “Delta of Impact.” In practical terms, CMS invests where marginal dollars save the most lives and reduce the most avoidable cost.

Why Some Clinics Win and Others Do Not

At the state level, agencies do not award funding based solely on need. They fund execution capacity.

High-performing FQHCs and RHCs consistently demonstrate three operational capabilities:

- Network Scalability

Consortium-based applications outperform single-site submissions by a wide margin. A coordinated regional strategy allows the state to fund fewer programs while achieving broader population impact. Clinics that align with two or more neighboring organizations are significantly more likely to secure seven-figure awards. - Digital and Operational Maturity

Baseline EHR functionality (Epic, Athena, eCW, or comparable platforms) combined with a clear API integration roadmap reduces perceived risk. Agencies are no longer funding “technology exploration.” They fund implementation certainty. - Workforce Continuity Planning

Rural staffing shortages are no longer treated as temporary challenges. Clinics that depend on local recruitment alone are viewed as operationally fragile. Virtual clinical floor models, using remote nurses, MAs, and care coordinators, demonstrate that services can be delivered regardless of local labor constraints.

- Network Scalability

The Four Elements Reviewers Now Expect

Successful proposals increasingly include four non-negotiable components.

A. Virtual Clinical Infrastructure

Funding requests focused solely on local hiring are frequently denied. Instead, reviewers expect hybrid staffing models that blend onsite care with remote clinical capacity.

The underlying logic is simple: funding must translate into access, not vacancies.

Language that consistently resonates includes:

“Ensuring clinical continuity through augmented remote staffing.”

B. Revenue Sustainability Through RPM and Digital Care

Grant programs are no longer designed as long-term operating subsidies. They are bridge investments.

Explicit integration of CMS RPM and digital care pathways particularly the 2026 CPT 99445 structures, signals that services will remain financially viable after grant periods conclude.

Key positioning:

“Financial sustainability through CMS-aligned remote care reimbursement models.”

C. Cybersecurity and Compliance Readiness

A growing portion of rural funding is earmarked for digital security. Data breaches in under-resourced systems now represent systemic risk, not isolated events.

Strong proposals address:

- SOC2-aligned controls

- Encrypted patient-device communication

- HIPAA-compliant cloud architecture

This is no longer optional infrastructure. It is foundational.

D. Outcome-Based ROI Commitments

States must justify these investments to legislatures and federal auditors. Soft narratives are insufficient.

Competitive applications quantify:

- 20–25% reduction in non-emergent ER utilization

- 10–15% improvement in HEDIS/MIPS quality metrics

- Measurable reduction in per-member-per-month Medicaid spend

The underlying question is always: “What will this save the system?”

From Strategy to Execution: The 30-Day Readiness Framework

Clinics that move early outperform those that wait for formal RFP announcements.

Week 1: Administrative Readiness

Audit UEI registration, SAM.gov status, and compliance documentation. Funding cannot be released without these foundations.

Week 2: Technology and Staffing Alignment

Select partners that provide both digital platforms and clinical staffing capability. Fragmented vendor models increase operational risk.

Week 3: Consortium Formation

Formalize regional partnerships with neighboring clinics. Shared data models and care protocols strengthen state confidence.

Week 4: ROI Narrative Development

Align proposed metrics with state Medicaid strategic priorities and population health objectives.

This is not grant writing. It is financial and operational positioning.

The Strategic Reality

The $50 billion Rural Health Transformation fund is not designed to modernize buildings. It is designed to modernize care delivery.

Requests centered on facilities, vehicles, or isolated equipment purchases reflect yesterday’s healthcare economics. The current funding environment prioritizes:

- Remote patient monitoring

- Virtual clinical staffing

- Digital access expansion

- AI-supported triage and care coordination

- Secure, interoperable data infrastructure

Clinics that align with these priorities will not only secure funding—they will stabilize margins, improve workforce resilience, and expand access in markets that have historically struggled to survive.

Final Perspective

This funding cycle will reshape the rural healthcare landscape for the next decade.

Organizations that treat it as a compliance exercise will remain financially fragile. Organizations that treat it as a transformation strategy will become regional anchors of care.

The race is already underway. The question is not whether funding will be awarded, but whether your clinic is positioned to earn it.

For more information, write to contact@medicalofficeforce.com

Informative!

Great Information

Appreciate the insights shared—very informative and valuable

This is a sharp, timely reality check. By reframing rural funding as a performance driven investment in execution capacity rather than a needs-based grant, you highlight what many clinics still miss. A must read for FQHCs and RHCs that want to compete, not just comply in the 2026-2030 cycle!!

Appreciate the insights shared—very informative and valuable

Very informative as this will help healthcare to improve in rural areas.

Great information

Fantastic

Great reminder that the right priorities can make a big difference in healthcare.

The $50B rural health race is real—and clinics that invest early in technology, strong revenue cycle management, and patient access will win. Those that delay adapting risk falling behind as funding, payers, and patients shift toward value, efficiency, and outcomes.

Quite Informative! Thanks.

This blog accurately reflects how funding decisions are shifting from need alone to execution and measurable outcomes. Well done, please keep posting insights like this.

VERY INFORMATIVE , AND CONSIDERATE !

Sharp, timely, and grounded in how CMS actually thinks. It clearly shows this isn’t grant chasing, it’s a survival and scale strategy for rural clinics

Highly informative with excellent insights

Great Information .

Great information !!

Good insight into where rural health funding is really headed.

Essential reading for anyone tracking rural health funding trends

Sharp, timely, and grounded in how CMS actually thinks. It clearly shows this isn’t grant chasing, it’s a survival and scale strategy for rural clinics

Very useful information with great Insights.

Great work! clinics that align with these priorities will not only secure funding as well as they will stabilize margins, improve workforce resilience, and expand access in markets that have historically struggled to survive.

Very Informative!

This is great for the healthcare and win win situation for patients ,Great information shared.

Great information !!

Concise and informative overview of the evolving rural health funding priorities……

Great Information!

Good insight into where rural health funding is really headed.

Looking forward to learning more about the $50 Billion Rural Health Race Plan and the strategy to accelerate growth in rural health

Very informative for the health and wealth.

Looking forward to learning more about the $50 Billion Rural Health Race Plan and the strategy to accelerate growth in rural health.

Great information !!

excellent information

I loved to know that clinics that align with these priorities will not only secure funding but also stabilize margins, improve workforce resilience, and expand access in healthcare.

Informative

Great insights on how rural clinics can leverage the $50B health transformation funds.