Nephrology in 2026: Can CKD Care Coordination Survive the Fee Schedule Cuts?

Chronic kidney disease (CKD) impacts millions of Americans. Good care coordination nurses, pharmacists, dietitians and doctors working together between visits slows disease, prevents hospital admission and allows patients to be healthier longer. But 2026 is an important year, as Medicare makes major changes to how it pays clinicians. This has nephrology practices asking: Can CKD care coordination survive these fee schedule changes?

The short answer is: Yes, but only if practices know how to adapt. Here, we explain what’s changing, why it matters for CKD care, and provide actionable options for practices to protect both patient care and revenue.

The Growing Challenge of Kidney Disease in America

About 1 in 7 U.S. adults (approximately 35 million people) have CKD. The disease is more prevalent with older age and among people with diabetes and high blood pressure. When clinics deliver ongoing, organized care between visits (tracking labs, adjusting medications, coaching dietary and fluid intake), they are able to slow kidney decline and reduce preventable hospital visits. These care coordination activities are sometimes reimbursed by Medicare, using time-based care coordination codes.

What changed in 2026 (the payment headlines you need)

A new Physician Fee Schedule (PFS) proposal for 2026. Please note that CMS published a CY-2026 PFS proposed rule in July 2025 where they update payment policies for many services.

1. One of the proposed changes is an “efficiency adjustment” which would eliminate work RVUs for many services that are not time-based. At the same time CMS suggested different conversion factors for certain APM participants versus non-participants.

2. Time-based care management does specifically exclude efficiency adjustments. CMS’s proposal acknowledged that codes that are paid for based on the documented amount of time spent (e.g. chronic care management) are not subject to that proposed efficiency adjustment. This meant that the payment protection exists for time-based care codes. This distinction is important for CKD programs that denote their coordinated care duration based on monthly minutes.

3. Dialysis facility payments go up slightly.

The ESRD Prospective Payment System for 2026 was proposed with an increased base rate of $281.06, which is an overall projected increase of about 1.9% for dialysis facilities which is beneficial, but not a replacement for the physician practice revenue.

4. Care management rules and concurrency limits still have real-world meaning and significance. Medicare is still allowing CCM (Chronic Care Management), PCM (Principal Care Management), TCM (Transitional Care Management) and ESRD MCP (monthly capitation payment) family, all with strict prohibitions for billing the same patient with overlapping codes (hospital-induced codes, for example, CCM can’t be billed in the same month that ESRD MCP claims for dialysis can be billed)! It is really important that you follow the rules to avoid denials.

What does this mean for CKD care coordination?

Some good news: Codes that pay for time spent coordinating care (the total monthly minutes spent by clinicians and clinical staff) are mostly protected from the proposed efficiency cut. In 2026, practices that can document time-based care work in order to bill for what they are doing have a much stronger reimbursement foundation.

The Challenge Ahead: Payments for some one-off or non-time-based services could be cut under the efficiency change. Practices that rely on episodic non-time based services may be responding to more pressure.

Dialysis patients are different: When a patient moves to dialysis, the ESRD MCP payment codes apply, and Medicare prohibits billing CCM at the same time. So the financial opportunity for CKD coordination is upstream, before the patient moves to dialysis.

Taking the next practical steps for nephrology practices

Focus upstream – Enroll patients earlier in CCM/PCM. Identify CKD patients with Stage 3–5 CKD who were not on dialysis and enroll them in CCM or in PCM appropriately. Care Attribution for pre-End Stage Renal Disease patients is the only safe revenue anchor available to nephrologists under the 2026 proposal.

Create workflows- Consistent monthly workflows are necessary to create billable time, including medication reconciliation, laboratory checks, medication titration (RAAS inhibitors, SGLT2s), dietary counseling, and contacting patients for missed laboratories. Document clinical staff and practitioner time at a minimum every month moving forward. Going forward, it is financially important to record time.

Use Transitional Care Management (TCM) properly. Following hospital stays (for example, admissions for fluid overload) bill TCM for immediate post-discharge care and then transition to CCM for continued care management – uses resources efficiently and decreases readmissions while ensuring short and long-term revenue when TCM is done well.

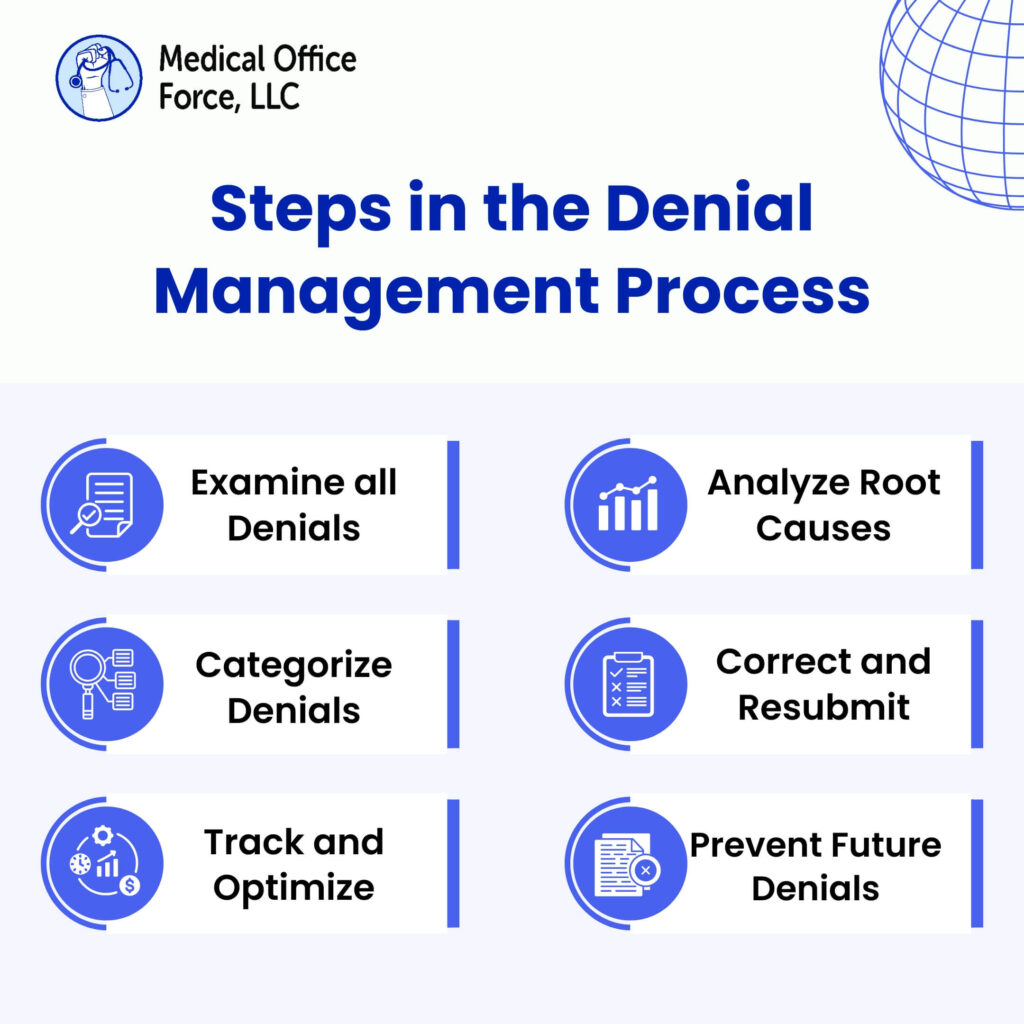

Prevent concurrency errors. Know which codes can’t be billed together (e.g., CCM and ESRD MCP in the same calendar month). Implement EHR checks or billing rules so staff don’t inadvertently submit conflicting claims. This will help prevent denials and audits.

Embrace virtual supervision and team-based care. The proposed updated regulations for 2026 support tele-supervision, telehealth flexibilities that allow RNs, pharmacists, and navigators to do much of the coordinating under physician supervision, which lowers the cost per minute but maintains quality.

Track results and show your value. Document avoided admissions, stabilized labs, and medication adherence. These outcomes are areas of contractual support for value-based models (like KCC) and build the business case for care coordination.

How Medical Office Force (MOF) Can Support Nephrology Practices

Medical Office Force specializes in taking the Administrative, Billing, and Workflow burden off busy clinical teams so they can provide better care while protecting revenue. Here is how MOF can work with you in your nephrology program:

1. Coding and Compliance Expertise. We ensure CCP, PCP, TCM, MCP, and related codes are billed correctly, concurrency rules are followed, and CMS guidance is adhered to – reducing denials and audit risk.

2. Revenue Cycle Optimization. We fine-tune claim submissions, reduce rejections and expedite collections so that care-coordination work translates into predictable cash flow even as the fee-for-service changes.

3. Workflow Design for a “Minutes Engine“. Medical Office Force assists nephrology practices to construct standardized care-coordination workflows that make it simpler to capture and document every billable minute through Chronic Care Management (CCM) and Remote Patient Monitoring (RPM). They build workflows that capture activities such as nurse follow-up phone calls, pharmacist-led medication review, dietitian counseling sessions, and even documentation templates, as part of protecting the time that isn’t otherwise billed for. This comprehensive methodology helps practices ensure that they are providing consistent and high-quality patient care and maximizing revenue or profitability by protecting the time that they weren’t able to bill for.

4. Performance report(RCM), and model support. For providers participating in value-based care models like Kidney Care Choices, Medical Office Force manages the tracking and reporting of key outcomes. This allows nephrology practices to clearly demonstrate cost savings, prove eligibility for shared savings programs, and prepare financially for 2026 and beyond. In addition, we provide tools to support Remote Therapeutic Monitoring (RTM) and Chronic Care Management (CCM), helping practices strengthen patient engagement while aligning with CMS reporting requirements.

Conclusion

When the 2026 Medicare proposals are evaluated, there will be defined winners and losers. The practices that survive and thrive will be those that:

1. Can successfully execute the time-based care coordination plan for pre-ESRD patients,

2. Start tracking and documenting monthly minutes (the minutes engine)

3. Avoid a billing concurrency error (i.e., avoid billing CCM with MCP),

4. Utilize virtual supervision and team-based workflows to keep costs down,

If your practice requires assistance in any of the items stated above – coding, staffing,etc.

Medical Office Force can do the heavy lift, so your clinical team can concentrate on caring for your patients. With the right operational changes implemented, even under the aforementioned 2026 medicare models, CKD care coordination is positioned to not just survive 2026, but may become the basis for a stronger nephrology program focused on value.

Abbreviations Used:

CKD – Chronic Kidney Disease

CCP – Comprehensive Care Plan

PCP – Primary Care Physician

TCM – Transitional Care Management

MCP – Monthly Capitation Payment

Sources

CMS, Calendar Year (CY) 2026 Medicare Physician Fee Schedule (PFS) Proposed Rule (CMS-1832-P). July 2025. Centers for Medicare & Medicaid Services

CMS, CY 2026 End-Stage Renal Disease (ESRD) Prospective Payment System (PPS) Proposed Rule (CMS-1830-P). June/July 2025. Centers for Medicare & Medicaid Services+1

CMS, MLN Booklet: Chronic Care Management (CCM), June 2025. Centers for Medicare & Medicaid Services

NIDDK / USRDS, CKD statistics and 2024 Annual Data Report. NIDDKUSRDS